Dollar edges higher, euro slips after weak PMI data

“The dollar losses from the softer June CPI report have now been erased in most USD crosses, with JPY, CHF and GBP standing out as a few key winners,” said analysts at ING, in a note.

“The dollar losses from the softer June CPI report have now been erased in most USD crosses, with JPY, CHF and GBP standing out as a few key winners,” said analysts at ING, in a note.

Oil prices fell to a six-week low on Tuesday, with Brent closing at its lowest level since June 9 on ceasefire talks between Israel and Hamas in a plan outlined by U.S. President Joe Biden in May and mediated by Egypt and Qatar.

Bitcoin came under pressure from increased uncertainty over the U.S. presidential race, especially after President Joe Biden dropped his reelection bid and endorsed Vice President Kamala Harris.

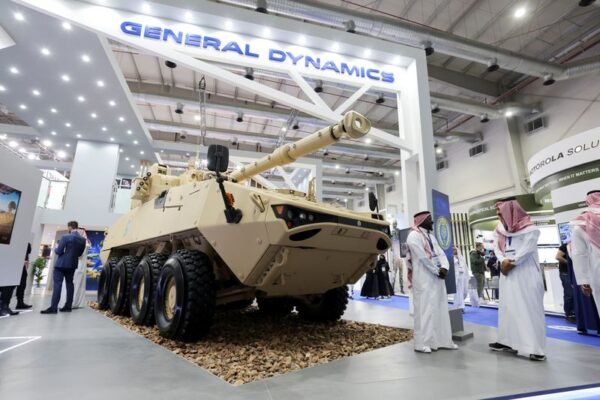

General Dynamics reported an 18% rise in second-quarter revenue on Wednesday, helped by higher demand for its ammunitions and nuclear-powered submarines and a 50% year-on-year jump in revenue from business jets.

The pick-up in Chinese convertible bond issuance is giving dealmakers hope that capital market activity will start to lift, especially in Hong Kong, where IPOs are at the lowest point in 15 years. The previous 12-month high was $10.9 billion in 2021.

The yen rose on Tuesday as investors reacted to comments from a senior Japanese politician that added to the pressure on the Bank of Japan to keep hiking rates to boost the currency.

Oil prices steadied on Tuesday after falling for the past two sessions, as investors remained cautious amid expectations of plentiful supplies and weak demand, while brushing off the U.S. presidential campaign upheaval.

The launch comes nearly six months after spot Bitcoin ETFs were approved for U.S. markets. While the launch had provided an initial boost to Bitcoin, driving it to record highs in March, the token has since floundered around the $60,000s for most part, while trading volumes in the ETFs also eased.

The government also increased the tax on transactions in equity derivatives segment. On futures trading, the securities transaction tax has been increased to 0.02% from 0.0125% and on options, it has been raised to 0.1% from 0.0625%.

Sri Lanka’s central bank is expected to hold interest rates for a second straight meeting on Wednesday as it attempts to maintain monetary stability in the shadow of a dragging financial crisis and counter simmering political tensions.