Japan January corporate service prices rise 2.1% yr/yr, BOJ says

The Bank of Japan is closely watching service price movements to see whether inflationary pressure is broadening in the economy to warrant phasing out its massive stimulus.

The Bank of Japan is closely watching service price movements to see whether inflationary pressure is broadening in the economy to warrant phasing out its massive stimulus.

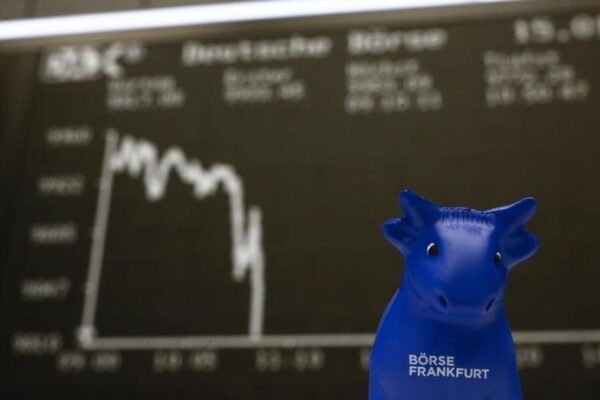

European stock markets slipped lower Monday, starting a new week on a cautious note as investors awaited the release of a series of keenly-awaited inflation cues. At 03:05 ET (08:05 GMT), the DAX index in Germany traded 0.1% lower, the CAC 40 in France traded down 0.2% and the FTSE 100 in the U.K. dropped 0.1%

The dollar was on the front foot on Monday ahead of a packed week filled with key economic releases that will provide further clues on the global interest rate outlook, with a U.S. inflation reading taking centre stage.

Difficulties in securing U.S. diesel complicate an existing supply crunch in Europe, which previously relied on Russian fuel exports. U.S. diesel cracks briefly surged to a four month high of over $48 a barrel this month, crimping arbitrage opportunities to ship the fuel to Europe.

The worst performers of the session were Nexon Co Ltd (TYO:3659), which fell 3.49% or 88.00 points to trade at 2,432.50 at the close. Dainippon Screen Mfg. Co., Ltd. (TYO:7735) declined 3.47% or 690.00 points to end at 19,205.00 and Asahi Group Holdings, Ltd. (TYO:2502) was down 2.69% or 147.00 points to 5,311.00.